Unintended Consequences of the FIDIC 2017 Clause 20.1 Claims Classification System

Written by Gabriel Mulero Clas |

October 29, 2018

FIDIC’s 2017 editions introduced a new Claims[1] management system in clause 20 that channels Claims through two very different procedures. One of them is very simple and involves almost no risk whereas the other will require investment of significant project resources, will take the parties a considerable amount of time to resolve and carries fatal consequences if not followed properly.

It has therefore become a priority for anyone handling this Claims management system to understand how clause 20.1 sorts the different types of Claims and to recognise that the classification scheme is not as straightforward as the wording of the Contract suggests.

FIDIC’s press release[2] explained that their intention was to differentiate time and money Claims, which would follow the more formal procedure in clause 20.2, from any other type of Claim, which would follow the simpler procedure. Unfortunately, despite their intentions, the language used in clause 20.1 suggests that not all money Claims may need to follow the more formal procedure.

The Three Types of Claim

Clause 20.1 governs the birth of certain Claims arising between the Parties and classifies them as set out below:

“A Claim may arise:

(a) if the Employer considers that the Employer is entitled to any additional payment from the Contractor (or reduction in the Contract Price) and/or to an extension of the DNP;

(b) if the Contractor considers that the Contractor is entitled to any additional payment from the Employer and/or to EOT; or

(c) if either Party considers that he/she is entitled to another entitlement or relief against the other Party. Such other entitlement or relief may be of any kind whatsoever (including in connection with any certificate, determination, instruction, Notice, opinion or valuation of the Engineer) except to the extent that it involves any entitlement referred to in sub-paragraphs (a) and/or (b) above.”

The first two types are defined by who makes the claim and what entitlement may be claimed whereas the third type is a catch-all category that covers any other entitlement.

The Two Procedures

Types (a) and (b) follow the procedure contained in clause 20.2 which includes, amongst other things, the submission of a written Notice of Claim, a subsequent fully detailed Claim document including evidence and updates to the Claim, formal content requirements for each document, obligations to maintain contemporary records, precise time bar provisions for each submission after which the claiming Party may lose their entitlement and follow up procedures in case of disagreements on the timeliness of the submissions.

Type (c) Claims follow the procedure at paragraph 20.1 (3). The claiming Party first requests the entitlement or relief against the other and the other Party or the Engineer must then disagree. There is no extraordinary formality on either of these other than following the basic requirements of communications under sub-clause 1.3 (e.g., being in writing, etc.) [3] and no specific time requirement. Once the disagreement is established, the claiming Party need only serve a simple Notice with details of the case and the disagreement to refer the matter to the Engineer. There is no specific time bar provision, update requirements, etc.

Therefore, the correct classification of a Claim is important because it may result in a more time-consuming procedure and the risk of loss of contractual rights.

Classification Scheme

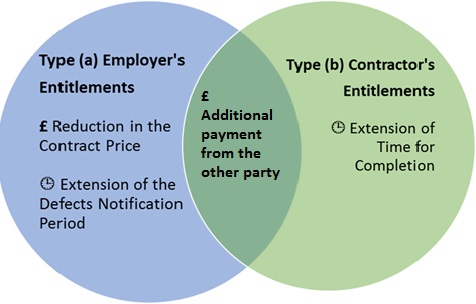

Type (a) and (b) Claims relate exclusively to four entitlements only one of which is common to both:

Type (c) Claims are for any other entitlement or relief of any kind whatsoever except for the four entitlements in (a) and (b). The list of what these Claims may relate to (e.g., certificates, instructions, etc.) is not exhaustive and does not limit or qualify the types of entitlements or reliefs that fall within type (c).[4] In other words, type (c) is for any Claim that is not for one of the four entitlements in types (a) and (b).

Clause 20.1 does not provide clear examples of a type (c) Claim. However, at the very least, any claim that does not relate to time or money would fall within the category. For example, a Contractor’s request for a declaration that the Engineer issue a Taking Over Certificate is not strictly about time and money. This event or circumstance may have time and money implications but the request for the declaration itself is not a claim for time and money. The Guidance of the 2017 editions confirms that declarations are type (c) and also mentions ambiguities or discrepancies in the Contract documents and access to Site issues as other examples.

On this basis, it may first appear that type (c) only includes Claims other than for time and money. However, the Guidance stops short of reaching this conclusion; it only provides a list of items that may fall within the category. [5] More importantly, there is nothing in the wording of clause 20.1 that makes it absolutely clear that no money claims may fall within type (c). As a result, the wording of type (c) has scope for money claims to fall within this category as long as they are not for additional payment from the other Party or reduction in the Contract Price.

Entitlements to Additional Payment

It should not escape anyone that the entitlement for additional payment is about money. However, the word additional limits the scope of the entitlement. As some commentators have already asked, what are these payments additional to? [6]

Bunni mentions that “a claim is generally taken in practice to be an assertion for additional monies due to a party” [emphasis of the author]. [7] Otherwise, claims would include Contractors’ payment applications for the original scope of works. [8]

Jaeger & Hoek have taken a more straightforward approach: additional payments comprise those that are “over and above [payments] which are already included in the accepted contract amount”.[9] Accepted Contract Amount (ACA) is a defined term that effectively means the sum agreed by the Parties in the Letter of Acceptance. Anything other than that is additional. Therefore, payments made for works carried out under the Contract are not additional.

As Jaeger & Hoek put it “claims are nothing more than the crystallisation of an anticipated, not yet specified, part of the Contract Price”.[10] This is consistent with the definition in clause 14.1 and the obligations in sub-clauses 3.7.4, 14.6.1 and 20.2.7 of the Yellow Book 2017. The Contract Price is the ACA subject to additions and/or reductions. These additions include entitlements to additional payment under clause 20 that may only become due pending or resulting from an Engineer’s determination. [11] In other words, additional payments are not part of the Contract Price from the moment the Contract is signed, only from the moment they become due which is sometime after the Notice of Claim is served.

Therefore, additional payment is any payment that is additional to the sum that the Parties originally agreed for the works when the Contract was signed and what has been added or reduced by the time the Claim arises. In other words, the payment is additional if it is not payable out of the Contract Price as adjusted by the time of the event or circumstance of the Claim.

Another point of view was that implied in the ICC Final Award 19581. [12] Whilst considering whether a claim for the return of a Retention Money Guarantee requires notice, the Arbitral Tribunal stated that the guarantee “does not constitute a consideration given in exchange of the works performed by Claimant or another form of “additional payment”.” [emphasis added] The use of the word another conflates payments given in exchange of the Works covered by the Contract Price and payments additional to that. It suggests that payments pursuant to the Contract Price and any other payment are one and the same so that the phrase additional payment is interchangeable with the phrase any payment. This view is incorrect. It leads to the misconception that additional means additional to zero or additional to what has been paid by the time the Claim is made whether or not the payment is anticipated as part of the Contract Price. One consequence would be that any request for money, including, as Bunni warns, [13] applications for payment of the works would effectively fall within the category. It would also render the word additional superfluous. The FIDIC forms are standardised contracts the result of decades of trial and error and painstaking drafting from a variety of professionals and the phrase has been included in previous versions of the FIDIC forms. Also, the commentators that have analysed the word additional in widely used books have been expressly acknowledged in the second edition as special advisers to the Contracts Committee or as having reviewed drafts. Therefore, the assumption should be that the use of the word additional has been carefully weighed and may not be ignored. This would be consistent with the principle of contract interpretation whereby each part of the contract should be given effect. [14]

The word should also be interpreted in the context of the entire clause. There should be no doubt that an EOT is an amount of time that is additional to the Time for Completion provided in the Contract Data. Also, clause 20.1 (a) entitles the Employer to either additional payment or a reduction in the Contract Price. Therefore, the baseline for any change to the sums that pass between the Parties is the Contract Price at the time the Claim arises.

Type (c) Claims for Payment of Unpaid yet Certified Work

An example of a type (c) money claim is a request for payment of a payment certificate for works carried out under the Contract that the Employer has failed to pay.

A Contractor’s claim for payment of an unpaid certificate is essentially a claim for a debt that results from the Employer’s non-payment in breach of clause 14.7 of the second edition. The Contract already provides the following remedies for this breach: financing charges (clause 14.8), suspension (clause 16.1) and termination (clause 16.2). However, there is no contract clause that specifically provides for the most obvious remedy: payment of the certified amount. Therefore, these claims rely on the law of the contract for payment of the unpaid sums. Consequently, this type of claim arises out of or is in connection with the Contract. According to sub-clause 1.1.5, a Claim is defined as under, in connection with and/or arising out of the Contract or its execution. Therefore, a claim for the sums of an unpaid certificate fits into the contractual definition of a Claim and may be subject to clause 20.1.

As explained above, the type (c) category is a catch-all provision that covers any entitlement other than the four entitlements of types (a) and (b), e.g., it covers entitlements for payments that are not additional. If the certificate covers work carried out under the Contract then such sums are payable out of the Contract Price. They are therefore Claims for another entitlement that is not additional payment and, as such, are not type (b). Also, type (c) expressly provides that the other entitlements may be in connection with any certificate or valuation of the Engineer, i.e., payment certificates are within its scope. As a result, these Claims should be classified as type (c).

The result of this classification is that a Contractor may be forced to refer to the short procedure in paragraph 20.1 (3) in order to obtain payment of certified work that has not been paid in the time allotted in the Contract.

short procedure. A mistake in categorising a Claim may result in, at worst, losing the right to a Claim and, at best, wasting valuable resources on a long and drawn out procedure.

Unintended Consequences

The second edition’s classification scheme is not as straightforward as it first seems. FIDIC’s press release about the 2017 edition makes it clear that the intention was for types (a) and (b) to cover all Claims for time and money and type (c) to cover Claims that are not.[15] However, this is not clear enough in the Contract itself. Most money Claims should be easily categorised under types (a) and (b). However, some may fall outside of these categories and must follow the type (c) procedure. The word additional results in some money Claims such as those for payment of an unpaid payment certificate for works carried out under the Contract to fall outside the remit of type (b). By phrasing type (c) so openly, it covers any entitlement whatsoever other than the four of types (a) and (b) including an entitlement for payment of unpaid certified works.[16]

Contractors, Employers and Engineers handling the new Claims management system should not immediately conclude that if the Claim is for time and money it goes through the long procedure and if it is non-monetary or non-temporal it follows the short procedure. A mistake in categorising a Claim may result in, at worst, losing the right to a Claim and, at best, wasting valuable resources on a long and drawn out procedure.

_____________________________________________________________________